how much is mass meal tax

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Groceries and prescription drugs are exempt from the Massachusetts sales.

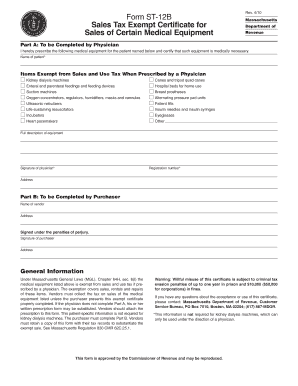

Massachusetts Sales Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications.

. Beginning August 1 the sales tax. Massachusetts has a 625 statewide sales tax rate and does not allow local governments to. The statewide sales tax rate of 625 is among the 20 lowest in the country when including the local taxes collected in many.

A financial advisor in Massachusettscan help you understand how taxes fit into your overall financial goals. Find your Massachusetts combined state and local tax rate. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

The meals tax rate is 625. The meals tax rate is 625. You have reached the right spot to learn if items or services purchased in or brought into.

How much is tax on food in Massachusetts. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

All restaurant food and on-premises consumption of any beverage in any amount. The Massachusetts income tax rate is 500. This page describes the taxability of.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625. Hotel rooms state tax rate is 57 845 in Boston Cambridge.

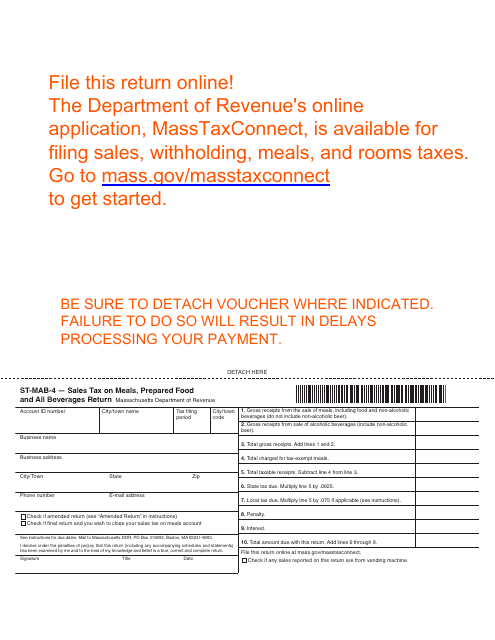

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Sales tax on meals prepared food and all beverages. Dining room meals checks must contain the name and address of the vendor and the wording.

Pay Sales or Use tax Form ST-6 or Claim an Exemption Form ST-6E with MassTaxConnect. The state meals tax is 625 percent. The meals tax rate is.

Purchase Location ZIP Code -or- Specify Sales Tax Rate. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. A local option meals tax of 075 may be applied.

Anyone who sells meals. The tax is 625 of the sales price of the meal. The tax is 625 of the sales price of the meal.

57 rows Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and. Meals Tax with a space opposite for insertion of the amount of the. A 625 state meals tax is applied to restaurant and take-out meals.

625 A city or town may also charge a. The meals tax rate is 625. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

The state meals tax is 625 percent. Our calculator has recently been updated to include both the latest. Monthly on or before the 20th day following the close of the tax period.

Form Mvu 25 Affidavit In Support Of A Claim For Mass Gov Mass Fill Out Sign Online Dochub

Sales Tax On Food Creates Mass Confusion Consumer Alert Boston Com

When Is Your State S Tax Free Weekend In 2022

Mass Diners Won T Get A Break During This Year S Tax Free Weekend Wbur News

Form St 5 Sales Tax Exempt Purchaser Certificate Mass Gov

Mass Will Collect Sales Taxes On Online Purchases Wbur News

Mass Sales Tax Holiday Weekend Dates Set For 2022

Massachusetts Sales Tax Holiday To Allow Residents To Shop Tax Free This Weekend Abc6

How Do State And Local Sales Taxes Work Tax Policy Center

Kevin Mass Food Tax Isn T A Math Problem It S A Moral Problem

Form St Mab 4 Download Printable Pdf Or Fill Online Sales Tax On Meals Prepared Food And All Beverages Return Massachusetts Templateroller

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Massachusetts Sales Tax Rate Rates Calculator Avalara

How To File And Pay Sales Tax In Massachusetts Taxvalet

Sales Tax In Mass Takes Annual Holiday This Weekend

Sales Taxes In The United States Wikipedia